Explore the intricacies of deferred tax assets and liabilities, and understand how they affect balance sheets, including common examples such as depreciation and installment sales.

Deferred Tax Assets

- A deferred tax asset is an item on the balance sheet that results from the over-payment or the advance payment of taxes

- A deferred tax asset can arise when there are differences in tax rules and accounting rules or when there is a carryover of tax losses

One straightforward example of a deferred tax asset is the carryover of losses. If a business incurs a loss in a financial year, it usually is entitled to use that loss in order to lower its taxable income in the following years. In that sense, the loss is an asset.

- A deferred tax asset is often created when taxes are paid or carried forward but cannot yet be recognized on the company's income statement

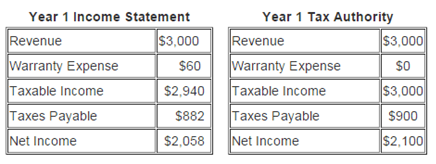

Another scenario arises when there is a difference between accounting rules and tax rules. For example, deferred taxes exist when expenses are recognized in a company's income statement before they are required to be recognized by the tax authorities or when revenue is subject to taxes before it is taxable in the income statement.

Most tax authorities do not allow companies to deduct expenses based on expected warranties; thus the company is required to pay taxes on the full $3,000.

Deferred Tax Liabilities

- A deferred tax liability represents an obligation to pay taxes in the future

- The obligation originates when a company or individual delays an event that would cause it to also recognize tax expenses in the current period

- It is calculated as the company's anticipated tax rate times the difference between its taxable income and accounting earnings before taxes

- Deferred tax liability is the amount of taxes a company has "underpaid" which will be made up in the future. This doesn't mean that the company hasn't fulfilled its tax obligations. Rather it recognizes a payment that is not yet due

For example, a company that earned net income for the year knows it will have to pay corporate income taxes. Because the tax liability applies to the current year, it must reflect an expense for the same period.

But the tax will not actually be paid until the next calendar year. In order to rectify the accrual/cash timing difference, tax is recorded as a deferred tax liability.

Depreciation example

A deferred tax liability usually occurs when standard company accounting rules differ from the accounting methods used by the government. The depreciation of fixed assets is a common example.

Companies typically report depreciation in their financial statements with a straight-line depreciation method. Essentially, this evenly depreciates the asset over time.

But for tax purposes, the company will use an accelerated depreciation approach. Using this method, the asset depreciates at a greater rate in its early years. A company may record a straight-line depreciation of $100 in its financial statements versus an accelerated depreciation of $200 in its tax books. In turn, the deferred tax liability would equal $100 multiplied by the tax rate of the company.

Installment Sale example

Another common source of deferred tax liability is an installment sale. This is the revenue recognized when a company sells its products on credit to be paid off in equal amounts in the future.

Under accounting rules, the company is allowed to recognize full income from the installment sale of general merchandise, while tax laws require companies to recognize the income when installment payments are made.

This creates a temporary positive difference between the company's accounting earnings and taxable income, as well as a deferred tax liability.

A company might sell a piece of furniture for $1,000 plus a 20% sales tax, payable in monthly installments by the customer. The customer will pay this over two years ($500 + $500).

In its financial records, the company will record a sale of $1,000.

In its tax records, it will be recorded as $500 per year for two years.

The deferred tax liability would be $500 x 20% = $100.